Payroll processing is vital for every business, especially in Singapore where strict rules govern compensation. At OpensoftHR, we recognize how smooth payroll management boosts productivity and keeps employees happy. In this article, we’ll break down the steps of payroll processing, tailored for Singaporean businesses, and show how OpensoftHR simplifies it all.

What is payroll processing in hr?

Payroll processing in HR in Singapore involves managing the financial aspects of employee compensation, including salary payments, statutory deductions, and tax compliance. In Singapore, payroll processing typically falls under the Human Resources (HR) function of an organization.

In the realm of modern business operations, the speed and accuracy of payroll processing can significantly impact organizational efficiency and employee satisfaction. At OpensoftHR, we understand the importance of seamless payroll management.

How does payroll processing work?

Payroll processing is the systematic and essential task of calculating employee compensation within an organization. Processing payroll in Singapore consists of specific requirements and considerations due to local regulations. It involves several steps to ensure accurate and timely payments to employees.

In this article, we will share a general outline of the 9 steps to process payroll in Singapore on a monthly basis.

Nine Steps to Process Payroll in Singapore

- Gathering Employee Information

- Syncing Payroll with HR Software (eg Time Attendance, Leave, Claim)

- Calculating Gross Pay

- Deduct Statutory Contributions

- Calculate Taxes

- Incorporating Benefits and Deductions

- Calculate Net Pay

- Processing Payroll

- Generate Pay Slips

1. Gathering Employee Information

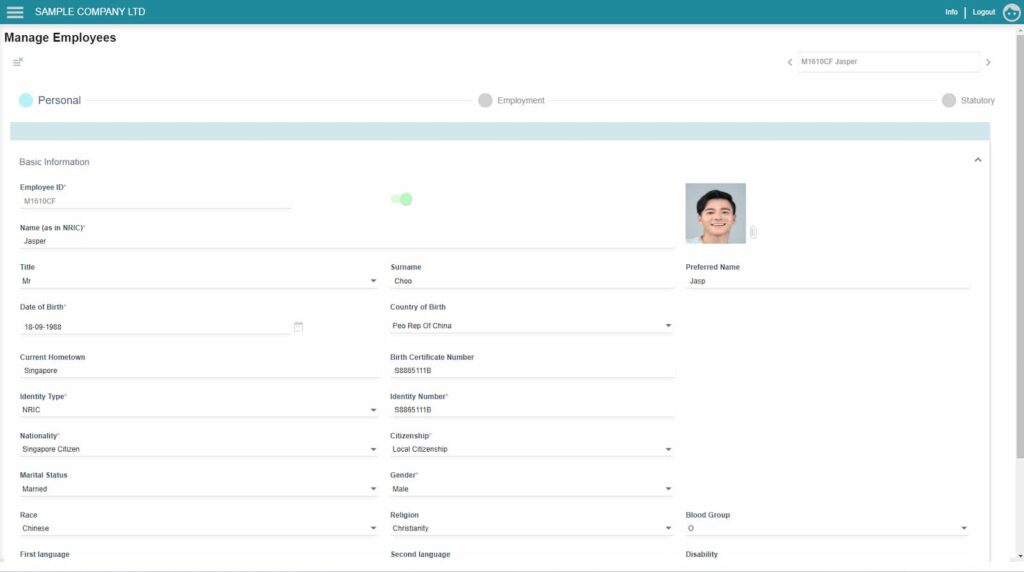

Collect necessary information for each employee, including their basic personal details, employment status, salary or wage rate, overtime hours (if applicable), and any other relevant information. OpensoftHR provides a streamlined interface to manage employee data efficiently.

The OpensoftHR Payroll and HRMS Software consists of a ‘Manage Employees’ section where you can store your each of your employee’s personal details (Eg Name, Citizenship, Identity number and more), Employment (Eg Bank details, Salary details, Date Joined details and more), and Statutory (Eg CPF).

2. Syncing Payroll with HR Software (eg Time Attendance, Leave, Claim)

2a. Time Attendance

Track employee attendance, hours worked, OT hours taken, and synchronize data seamlessly with OpensoftHR.

If you use OpensoftHR Time Attendance software, you will be able to sync all the data with your payroll. This means that any Overtime pay, Late Clock-ins and more will be automatically reflected in your OpensoftHR Payroll software, which ensures that your employees get paid accurately without you having to crack your brain cells to manually calculate their pay.

2b. Leave Management

Sync your company leave data with payroll to reflect time-off and no-pay leave accurately.

Sometimes your employees may take time-off or no-pay leave. When you synchronise your company’s e-leave data with your OpensoftHR Payroll software, their time-off and no-pay leave for the month will automatically be synced over to Payroll and will be reflected on the payslip after Payroll Processing is completed for the month.

2c. Expense Claims

Allow employees to submit claims directly, which can be synchronized with payroll for reimbursement.

With OpensoftHR Expense Claim software, your employees will be able to submit their claims directly to the platform. Once approved, your administrator can sync the latest expense claims to your payroll software and everything will be reflected in the Payroll system.

You will then be able to reimburse your employees’ claims via the Payroll software. The reimbursed claims will also be reflected on your employee’s MOM Itemised Payslip.

3. Calculating Gross Pay

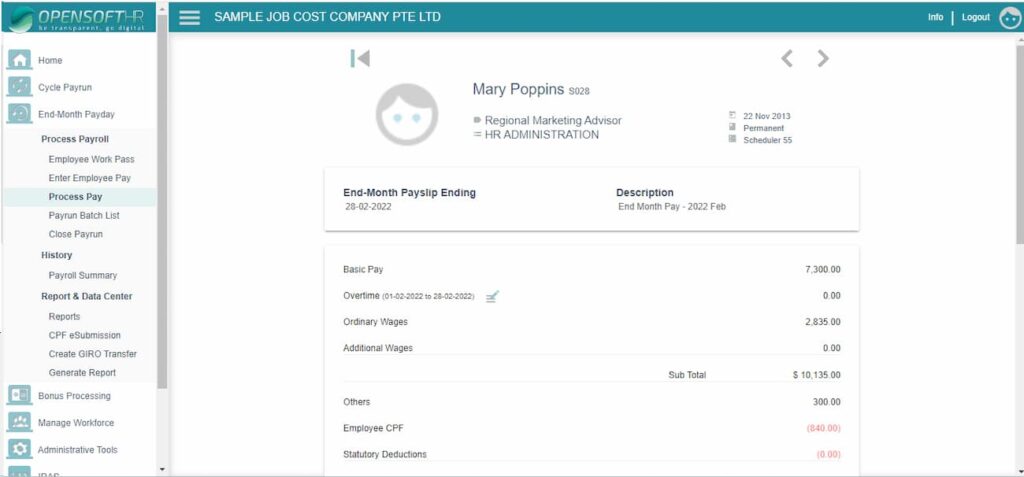

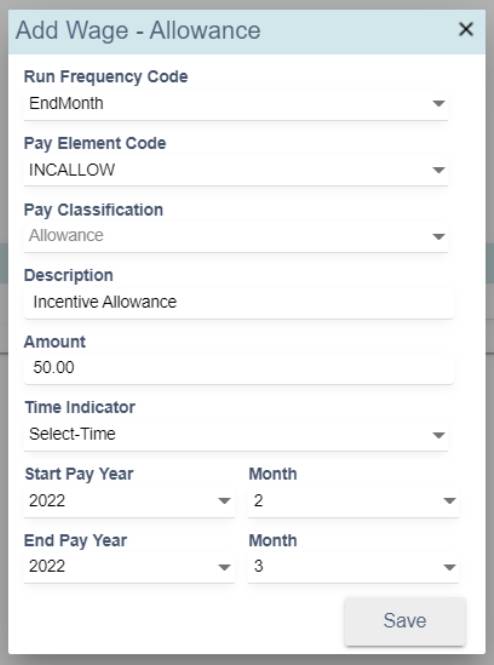

With OpensoftHR Payroll software, it can help you calculate each employee’s gross pay based on the hours worked, overtime, allowances, and any other applicable payments. Best of all, everything will be reflected in the employee’s payslip so they can get a better idea of their pay without having to check in with HR.

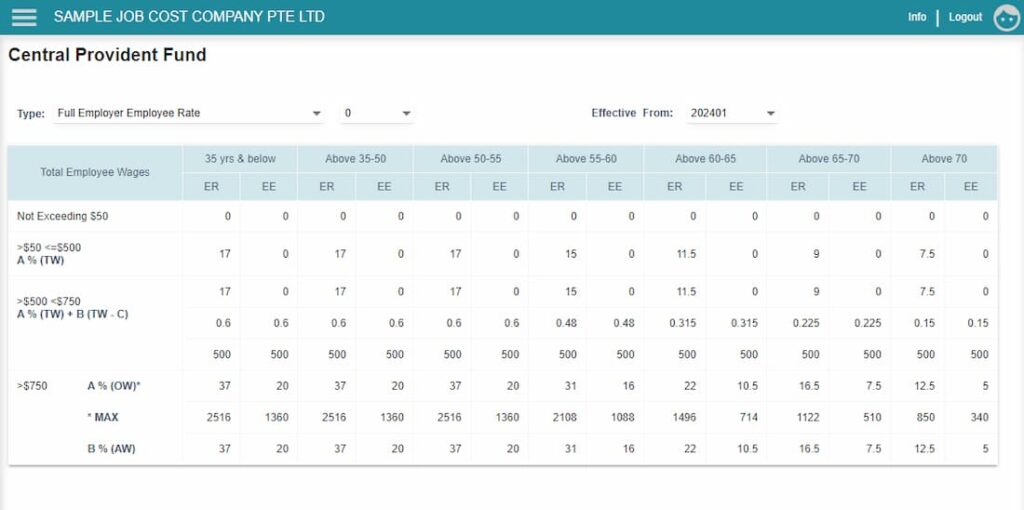

4. Deduct Statutory Contributions

It is important to accurately deduct statutory contributions. In Singapore, the Statutory contribution rates are always changing and can be quite complicated to calculated. For example, for the CPF Contributions, different age ranges are entitled to different CPF Contributions.

With OpensoftHR Payroll Software, you can ensure accurate deduction of statutory contributions like CPF Contributions, Foreign Workers Levy (FWL), National Service (NS), Skill Development Levy (SDL), and Ethnic Fund using OpensoftHR’s up-to-date payroll system.

5. Calculate Taxes

It is important to Automatically calculate and deduct income tax based on employees’ tax residency status and income level, ensuring compliance with Singapore’s progressive tax rate system.

In Singapore, as of the time of this writing (March 2024), taxes are deducted once a year every April. It is extremely important for companies to submit their taxes on time. Good news is that all your employee’s taxes are already automatically calculated based on their payroll, and hence, all you need to do is to check through and click a few buttons to submit the taxes for all your employees. Find out more about what you need to note about IRAS in Singapore. deduct statutory contributions.

6. Incorporating Benefits and Deductions

With OpensoftHR, you can integrate employee benefits and voluntary deductions into the system, including health insurance, retirement contributions, and additional wage adjustments. Everything will then be reflected on the payslip after Payroll has been processed.

7. Calculate Net Pay

After the gross pay, Statutory contributions, any additional benefits and deductions have been updated to the system, you can use OpensoftHR Payroll Software to automatically subtract all deductions from the gross pay to determine the employee’s net pay, providing a comprehensive view of earnings and deductions.

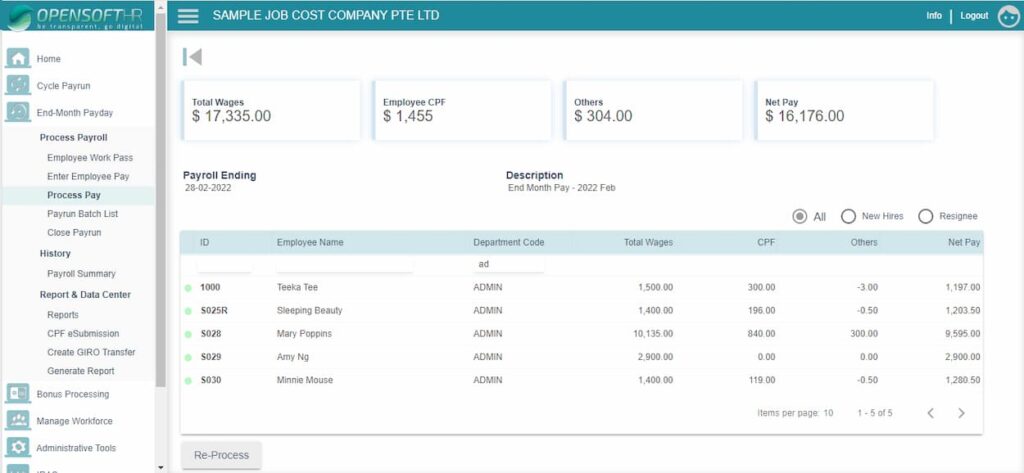

8. Processing Payroll

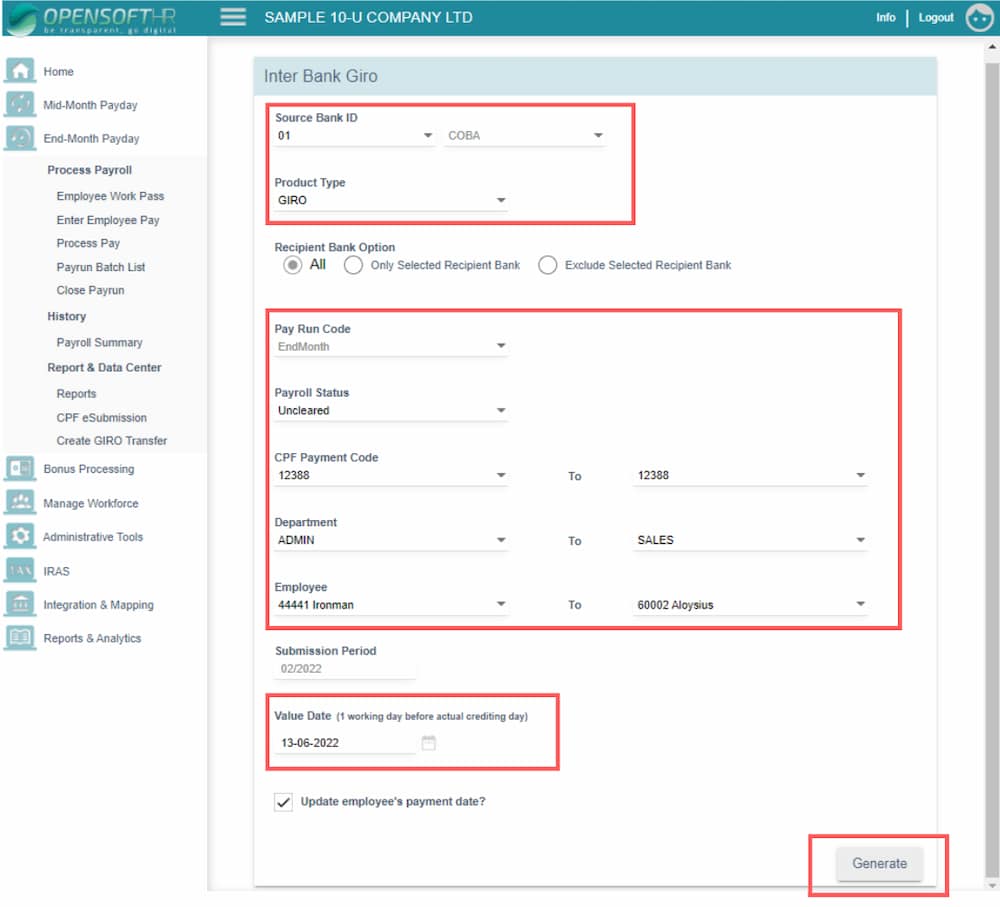

Once all the necessary calculations are made, you can process payroll seamlessly with OpensoftHR automated payroll software, facilitating direct deposits into employees’ bank accounts.

With OpensoftHR Payroll Software, this involves Inter Bank Giro or electronic funds transfers (EFTs) to deposit funds directly into employees’ bank accounts.

You can save a significant amount of time and reduce a huge load of human error if you process your payroll with a good payroll system such as OpensoftHR Payroll Software.

9. Generate Pay Slips

With just a click of a button, you can provide employees with detailed MOM-compliant itemised payslips outlining their earnings, deductions, and net pay for the pay period. Pay slips are typically distributed electronically via email or in hard copy format. You can even download the payslips and issue them out to your employees via Whatsapp.

Conclusion

By following these steps and leveraging OpensoftHR’s robust payroll software, businesses can effectively manage payroll processing in Singapore, ensuring accuracy, compliance, and efficiency.

In addition to efficient payroll processing, OpensoftHR offers features such as statutory report filing, record maintenance, compliance monitoring, and year-end reporting, further streamlining HR operations. Reach out to us for a free non-obligatory demo of OpensoftHR Payroll and HRMS today.

Home

Home