In the world of human resources and business management, payroll is a vital need in all companies. It’s not just about paying employees; it’s about ensuring accuracy, compliance, and employee satisfaction. Yet, one size does not fit all when it comes to payroll management. Every company from varying industries has its own needs and requirements when it comes to Payroll. For example, construction companies are heavily dependent on clock in clock out systems when it comes to their payroll and they may need to pay overtime often.

OpensoftHR Payroll software, recognized by IMBA Singapore and eligible for the Productivity Solutions Grant, stands at the forefront, offering tailored payroll solutions to meet the distinct needs of businesses across various sectors.

Understanding Payroll Customization

Customizing payroll solutions involves adapting systems to suit the unique requirements of businesses. Basic Payroll solutions often fall short in accommodating diverse tax regulations, payment methods, and reporting needs. For businesses leveraging either OpensoftHR Payroll Standard or Premium Versions, customization extends beyond flexibility; it embodies scalability, adaptability, and efficiency.

Benefits of Payroll Customization

The benefits of payroll customization extend across accuracy, efficiency, and employee satisfaction. With OpensoftHR Payroll, businesses experience:

Improved Accuracy

By customizing payroll settings, businesses can ensure accurate calculations and compliance with tax regulations, reducing the risk of errors and penalties.

Enhanced Efficiency

Customizable features streamline payroll processes, saving time and resources. With OpensoftHR Payroll, businesses can automate repetitive tasks and focus on strategic HR initiatives.

Employee Satisfaction

Customizable payment methods and deductions cater to employees’ individual preferences, enhancing satisfaction and engagement in the workplace.

To find out more about how OpensoftHR Payroll can help your business, you can check out the Product Demo of the OpensoftHR Payroll Software below:

10 Key Features of Customizable Payroll Systems

OpensoftHR Payroll boasts a comprehensive suite of customizable features designed to cater to businesses of all sizes.

Here are ten key features that are highly useful for Small and Medium Businesses:

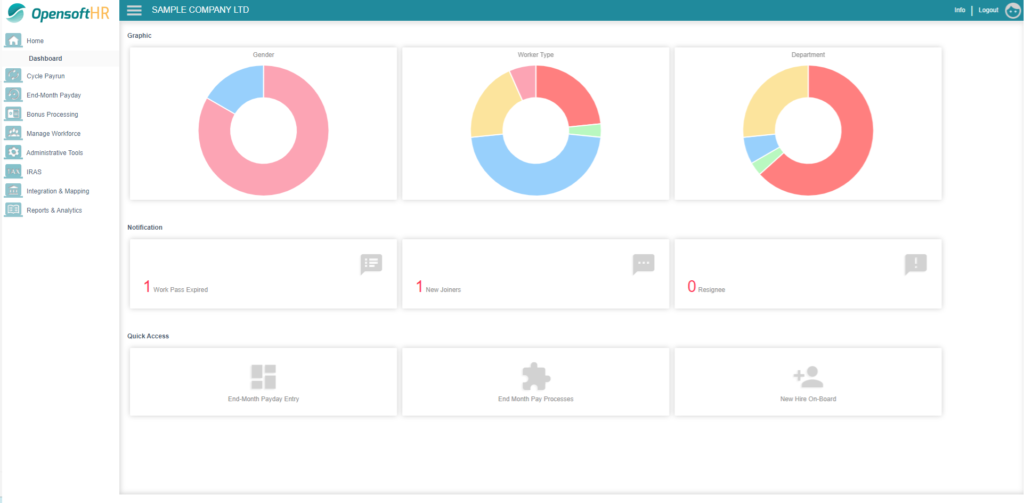

1. Payroll Dashboard Overview

Gain instant insights into essential payroll metrics, such as expired passports, overtime pay, and employee resignations, through the intuitive dashboard interface.

2. Tax Configurations

Customize tax settings compliant with specific regulations, including income tax, social security, and central provident fund contributions.

For example, under the Contribution Fund, you will be able to select which contribution fund each employee should be matched to – CDAC, ECF, MBMF, ISNDA, SHARE or SDL. You can also manually key in the contribution amount under the selected Contribution Fund. Other items you can edit under the Statutory Tab are your employee’s Permit-To-Work Details, Income Tax and Central Provident Fund (CPF) Contributions.

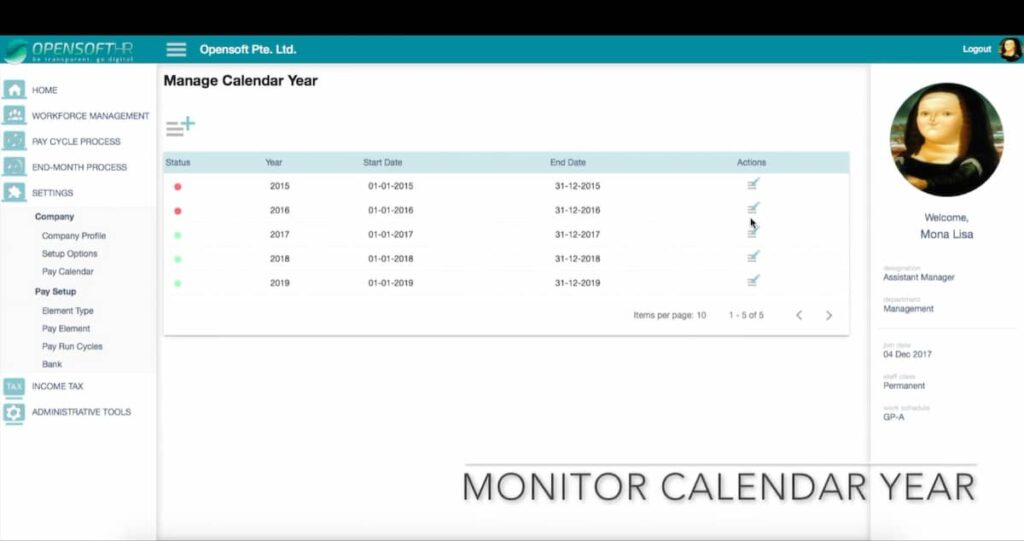

3. Manage Calendar Year

Easily configure calendar year settings tailored to your organization’s fiscal cycle, ensuring relevance and accuracy.

For example, the Calendar Year for your company may be ‘Jan’24-Dec’24’ or ‘April’23 to March’24’ or something else. The ‘Manage Calendar Year in OpensoftHR allows you to easily configure the Calendar Year Settings that best suits your organization’s needs, and ensure that it is always relevant and up to date.

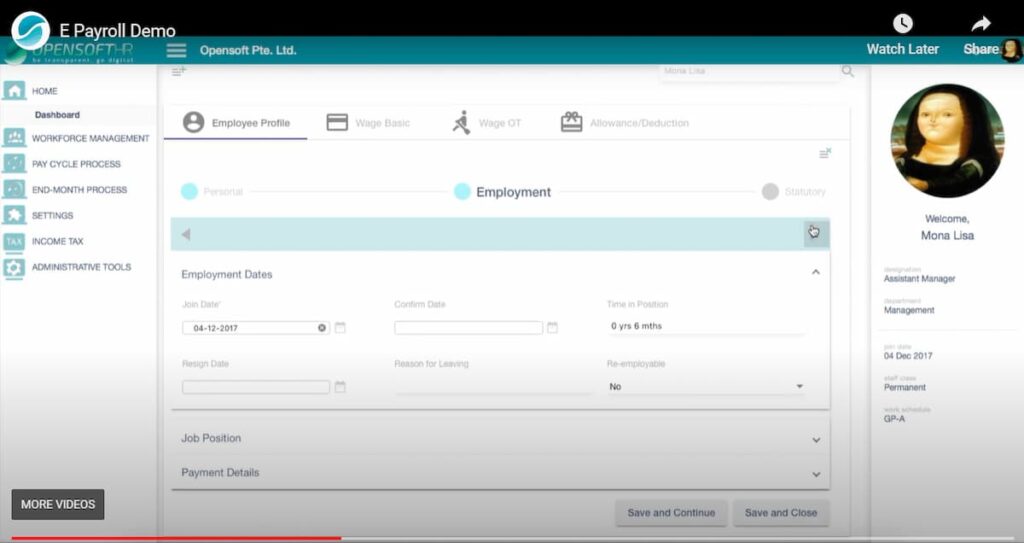

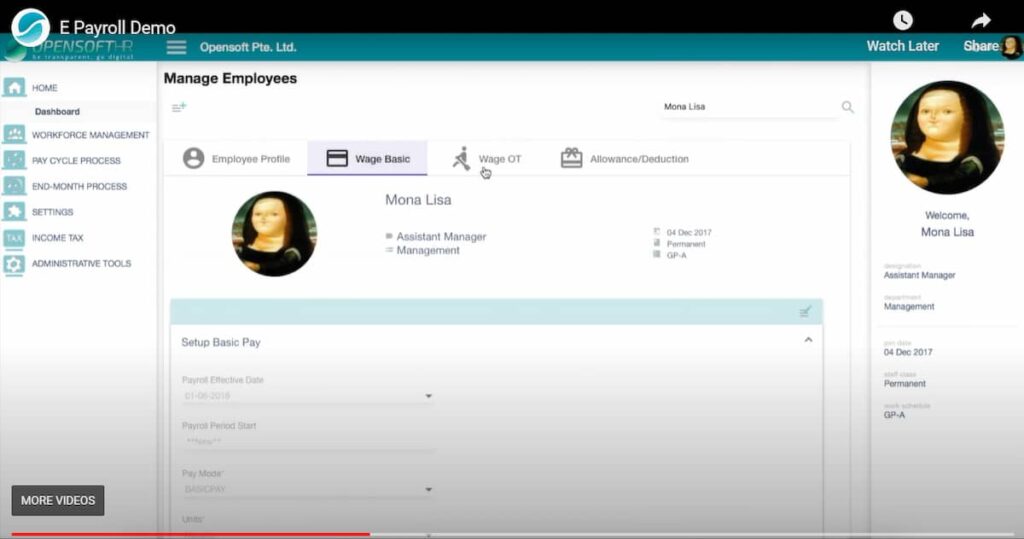

4. Employee Wage Configuration

Individualize basic pay and overtime rates for each employee to comply with regulatory standards.

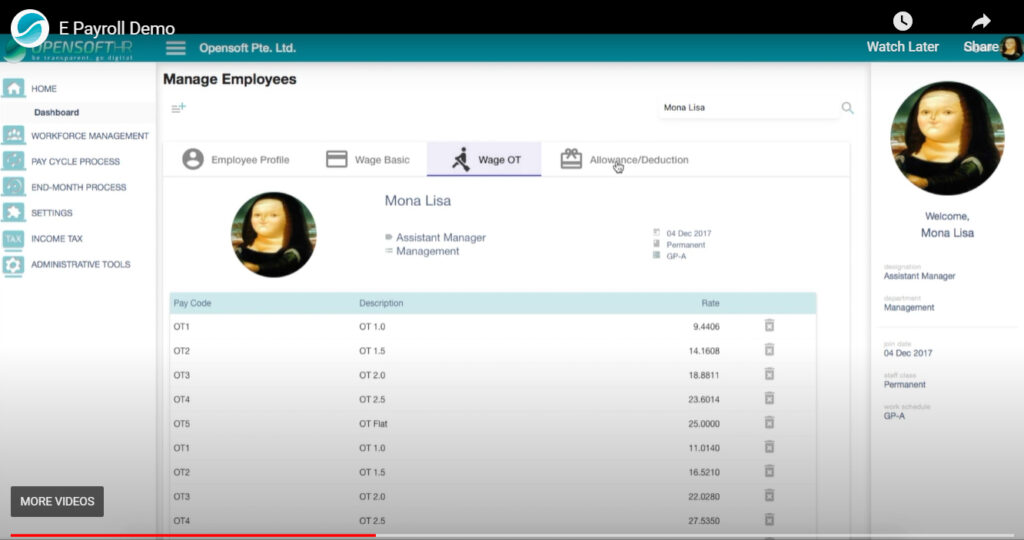

You can use OpensoftHR Payroll Software’s Wage Basic Function to setup Basic Pay and Overtime Pay:

OpensoftHR Payroll’s Wage Basic function allow you to setup each employee’s Basic pay and and the Wage OT function allows you to setup each employee’s OT pay. According to MOM (as of February 2024), the following working overtime employees are entitled to mandatory overtime pay:

- A non-workman earning a monthly basic salary of $2,600 or less.

- A workman (e.g. persons engaged in manual labour or persons in jobs stated in the First Schedule of the Employment Act, such as cleaners, bus/train drivers, or construction workers) earning a monthly basic salary of $4,500 or less.

If you have employees that are entitled to get OT pay, you will need to configure their Wage OT correctly so that it is compliant with Singapore’s mandatory overtime pay rule mentioned above.

5. Allowance and Deduction Settings

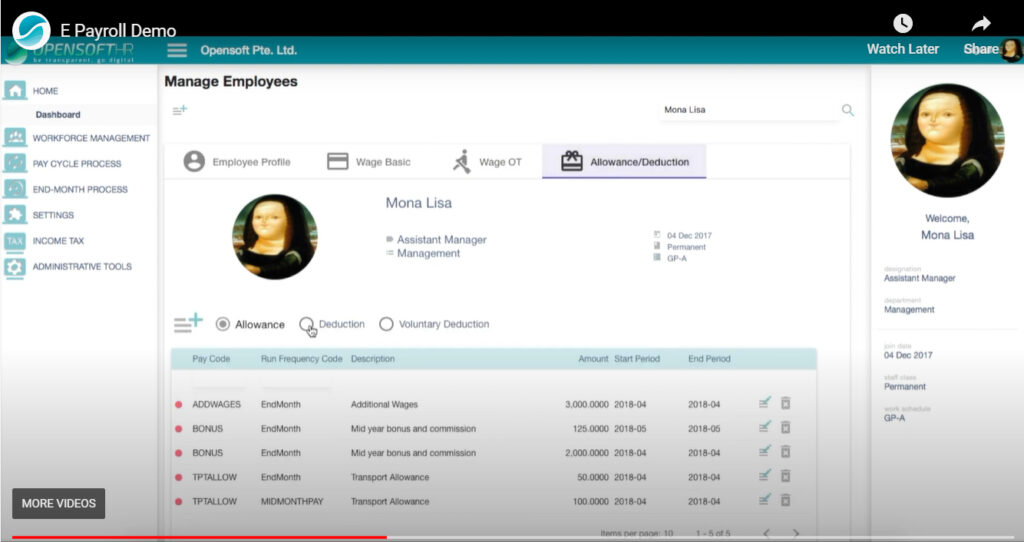

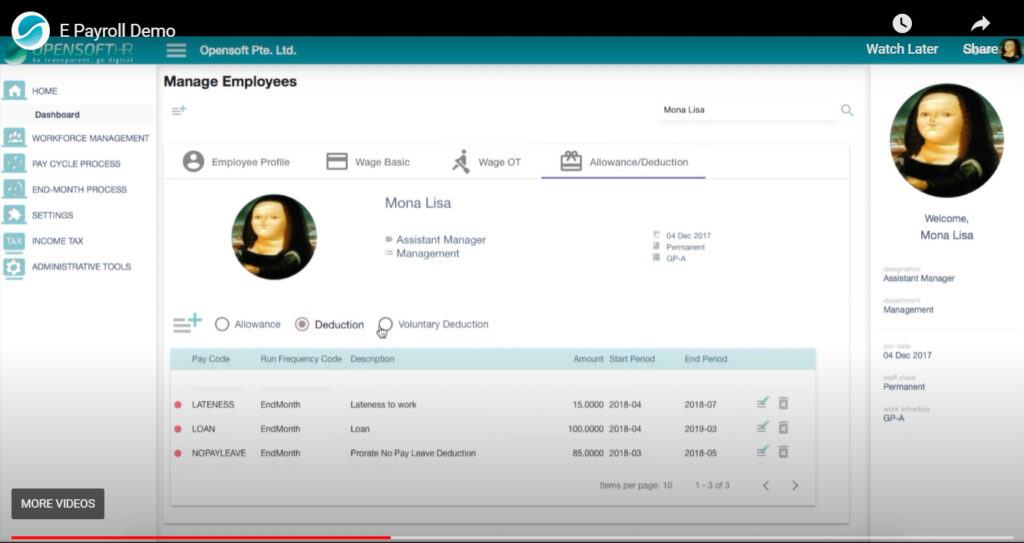

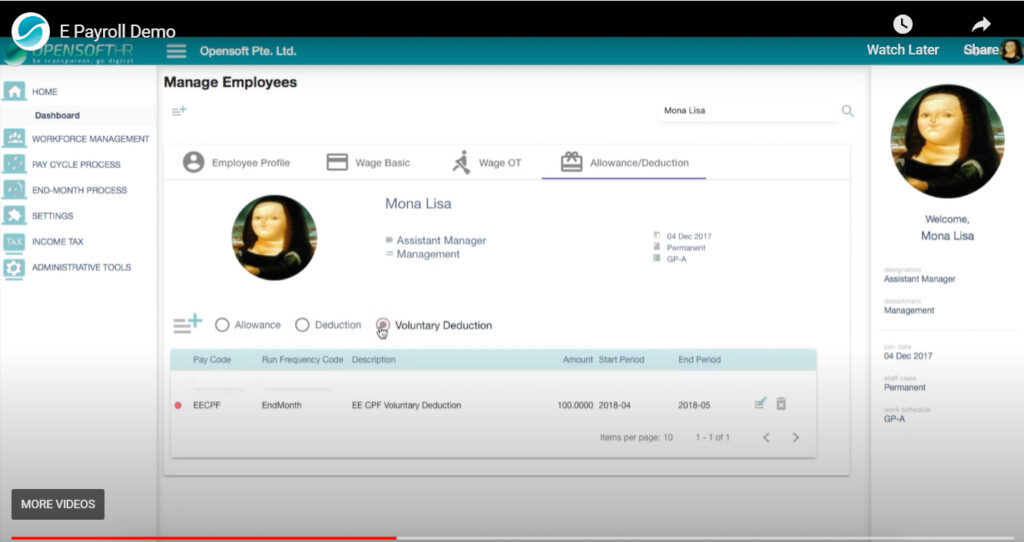

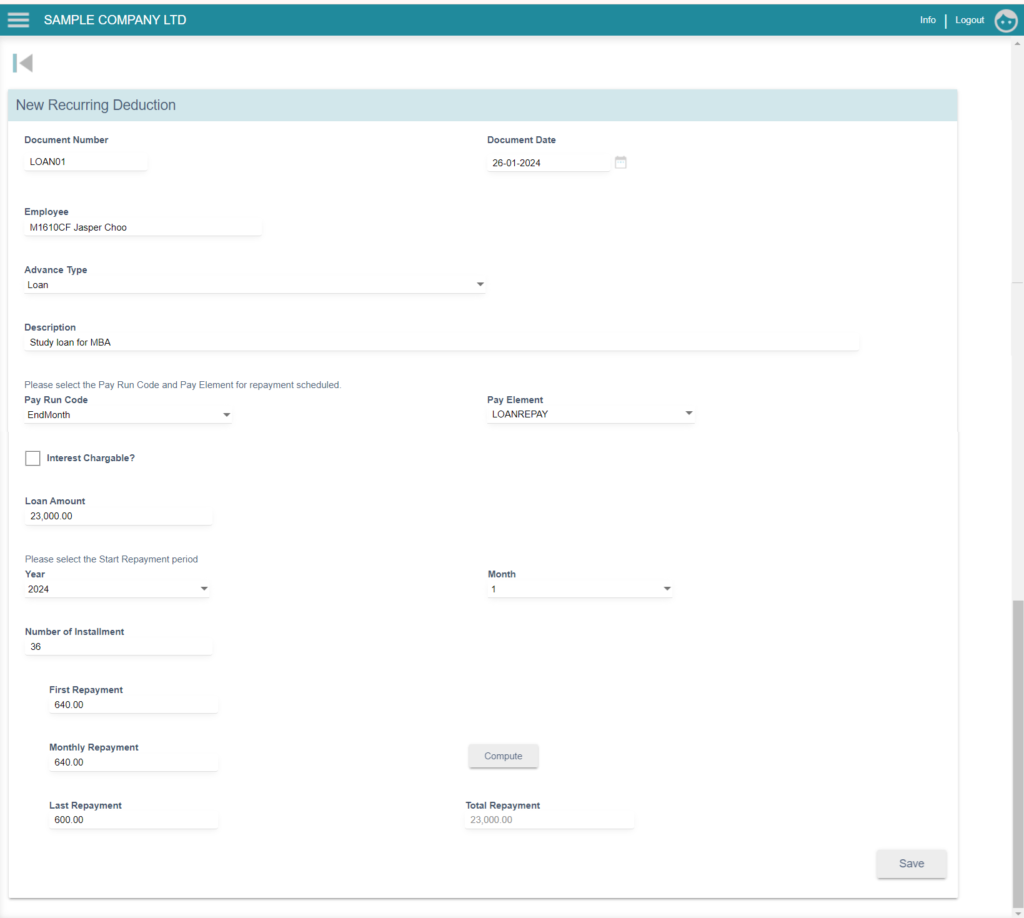

Set up custom deduction categories, such as lateness to work and loan repayments, on either an ad-hoc or recurring basis. This level of customization empowers businesses to tailor payroll allowances or deductions to meet the needs of their employees.

Here is an image that shows an example of deduction settings you can configure with OpensoftHR:

6. Payment Methods

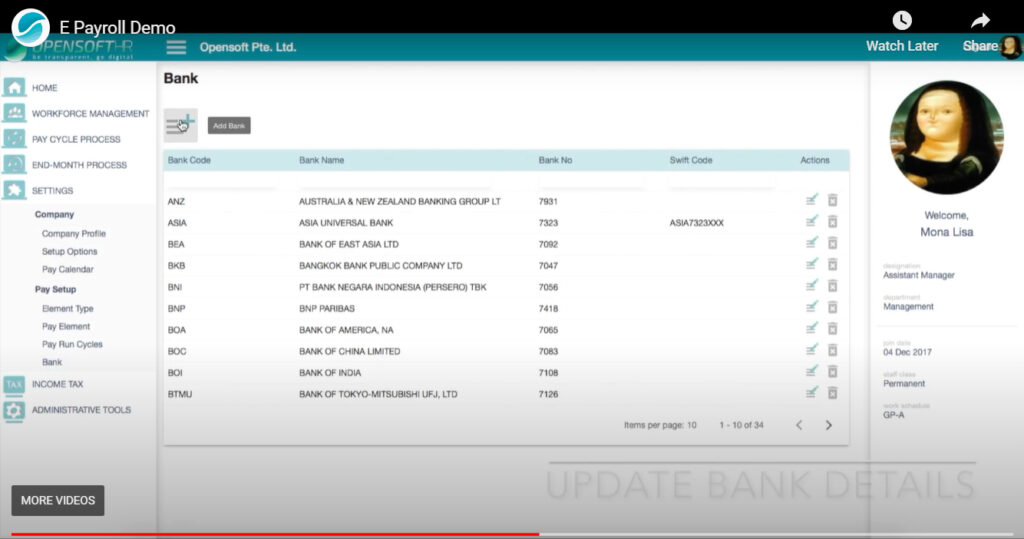

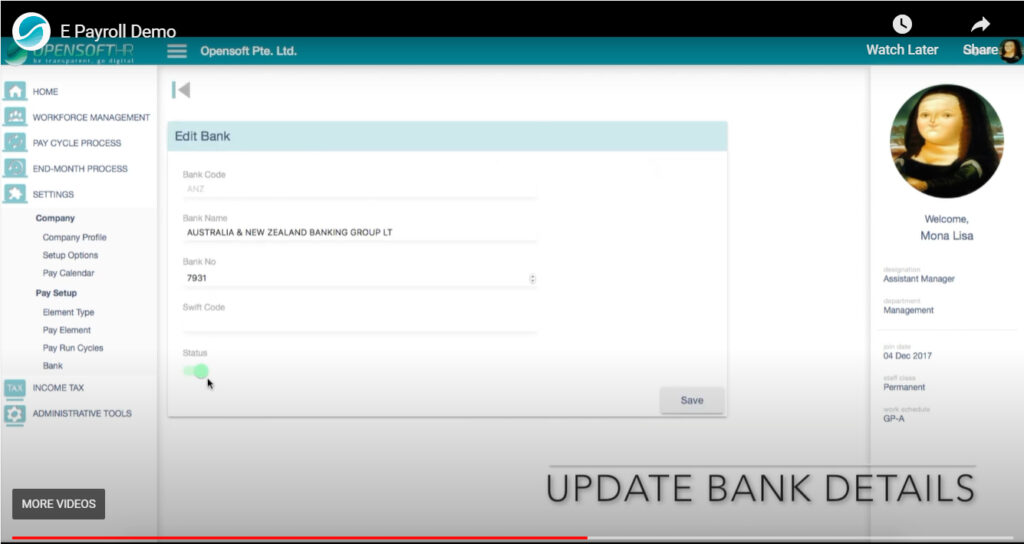

With OpensoftHR Payroll Software, organizations can choose the payment method and banks that best suit their employees’ preferences and organizational requirements.

7. Reporting Capabilities

Generate custom reports based on specific payroll data. Whether it’s payroll summaries, tax filings, or employee earnings statements, OpensoftHR Payroll software provides the flexibility to create and customise reports to meet business needs.

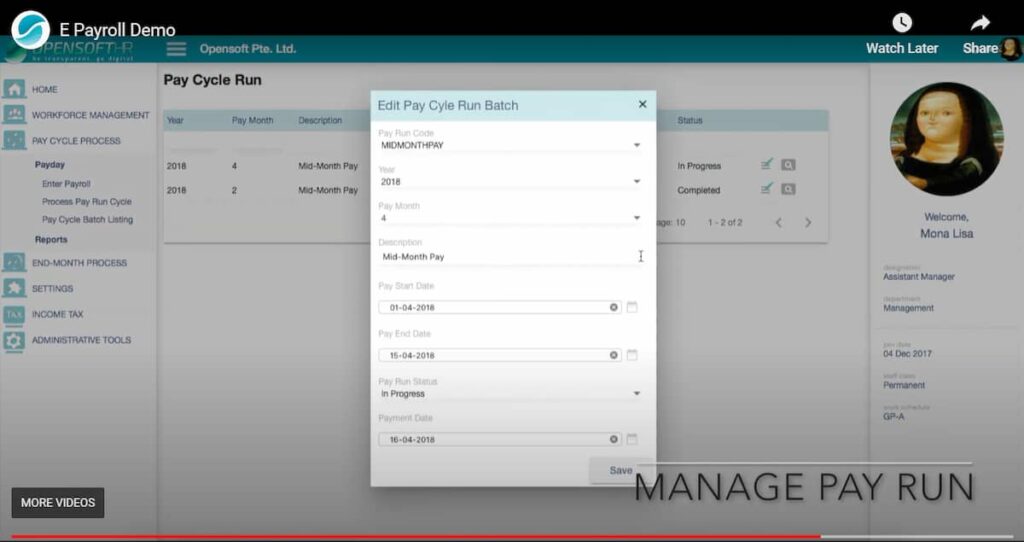

8. Management of Pay Run

Efficiently manage various pay cycle runs and employee bonuses, ensuring accuracy and compliance.

Your company may require different Pay Cycle Runs for different employees. With OpensoftHR Payroll, you can use the Edit Pay Cycle Run Batch Function to manage the various types of Pay Cycle Runs. You will have the flexibility to pay your employees once a week, twice a month, once a month, etc.

The best part is that everything will be recorded in the system so you can easily track back on every employee’s Pay Cycle Run using OpensoftHR Payroll Software.

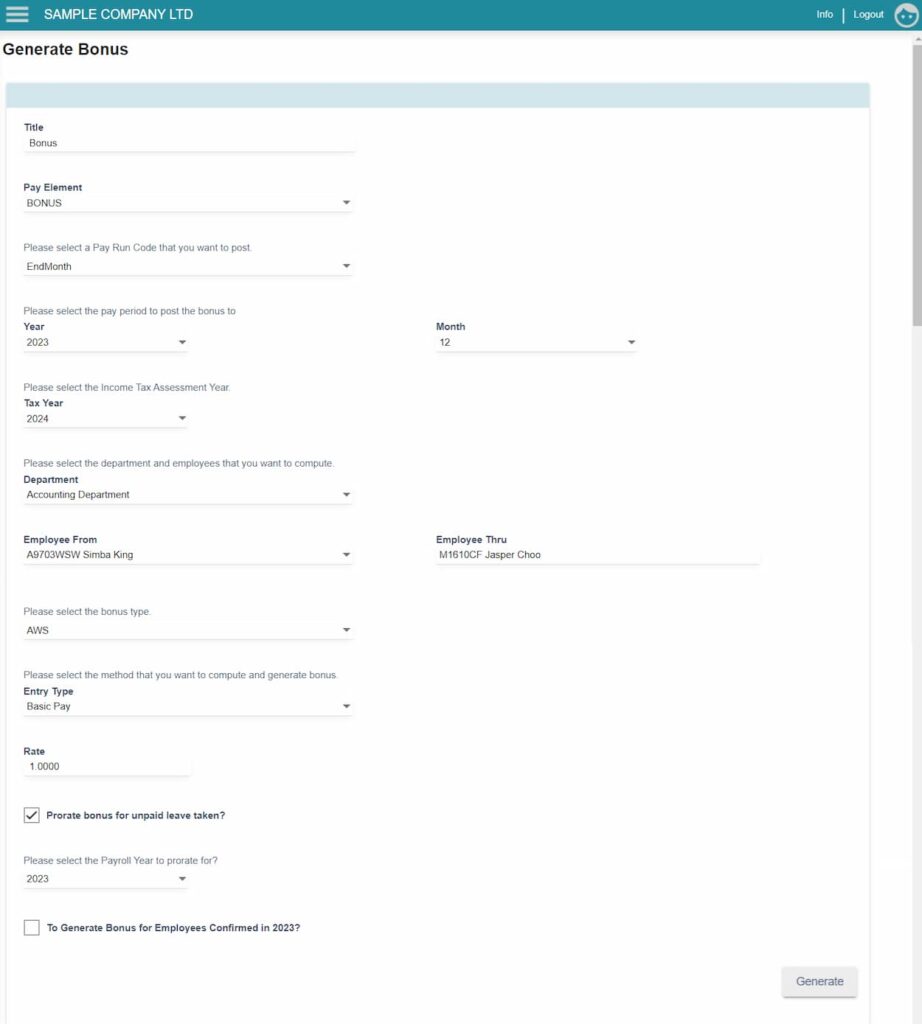

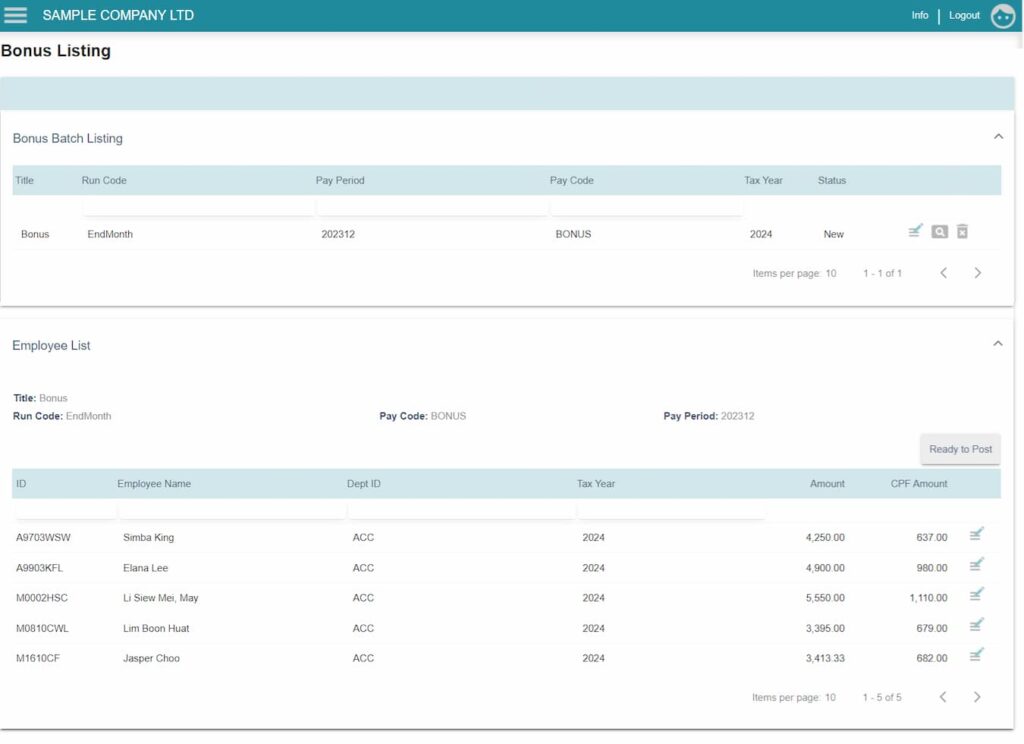

9. Bonus Processing

Managing bonuses for employees is a critical aspect of payroll administration. Each employee’s bonus structure may vary based on factors such as performance, tenure, and company policies. OpensoftHR Payroll simplifies bonus processing by offering customizable options tailored to individual employee needs.

Every employee’s bonus may differ, ranging from allowance bonuses to variable bonuses, based on performance metrics and organizational objectives. With OpensoftHR Payroll, the complexity of bonus calculations is streamlined, eliminating the need for manual calculations and potential errors.

By leveraging customizable bonus processing features, businesses can ensure fairness and transparency in bonus allocation while adhering to company policies and regulatory requirements. OpensoftHR Payroll empowers businesses to manage bonus structures efficiently, enhancing employee satisfaction and fostering a culture of performance-driven rewards.

Integrate bonus processing seamlessly into your payroll workflow with OpensoftHR Payroll and experience the benefits of automated, customized bonus management for your organization.

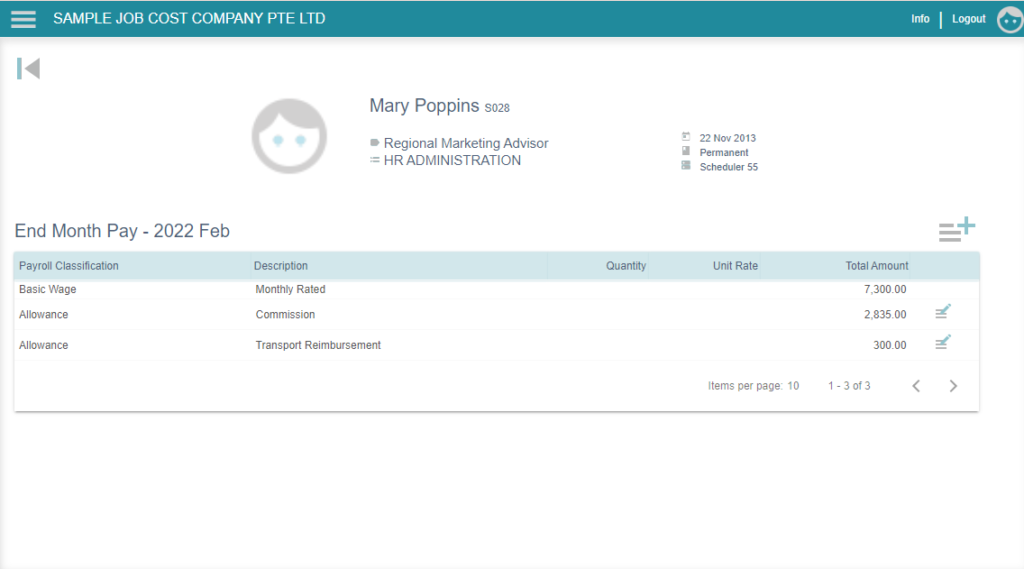

10. Sales Commission Management

Customise commission schemes for sales employees, ensuring accurate and timely payouts.

If you have sales staff, you will need a commission scheme to pay out to your sales employees. OpensoftHR Payroll comes with a commission function, where you can customise the commission for your sales employees. This commission configuration can be updated monthly or yearly, so the software is always up to date with your Sales Commission Plan

Conclusion

Payroll customization is not merely a luxury but a necessity for modern businesses. OpensoftHR Payroll empowers organizations to streamline processes, ensure compliance, and drive employee satisfaction through tailored solutions.

Ready to unlock the potential of payroll customization with OpensoftHR Payroll? Contact us today to get a free demo on how OpensoftHR Payroll and HRMS can transform and improve your business HR operations.

Home

Home