What is an itemized payslip?

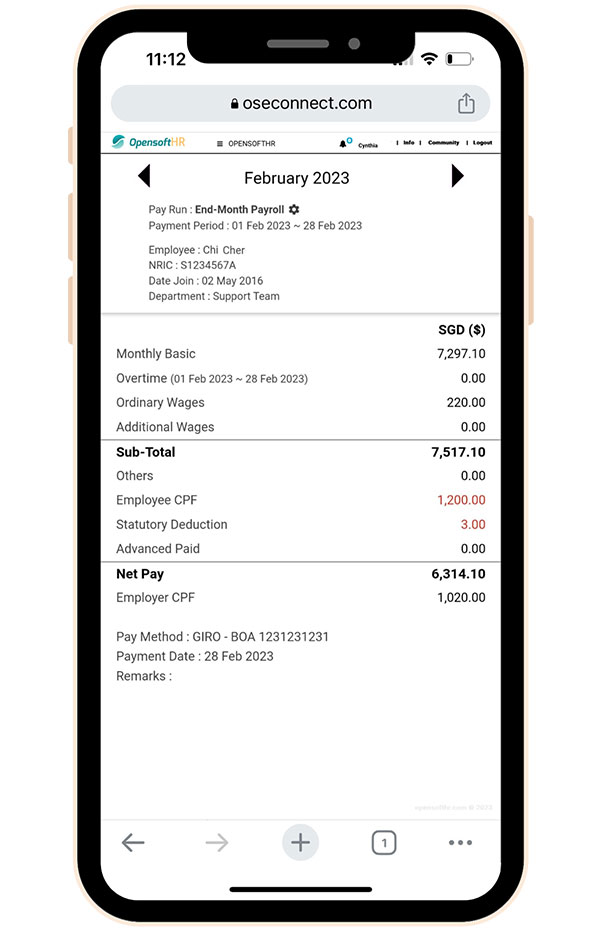

An itemised payslip is a detailed document provided by employers to employees, outlining the breakdown of their salary or wages. It includes information such as gross earnings, deductions for taxes and benefits, and the net amount received by the employee. This transparency helps employees understand how their pay is calculated.

What are the labor laws to take note of in Singapore?

In Singapore, key labour laws include the Employment Act, which covers basic terms and conditions of employment, such as working hours, leave entitlements, and termination procedures. Employers must also adhere to the Work Injury Compensation Act for workplace injuries and the Central Provident Fund Act for mandatory savings. It’s advisable to stay updated on any changes and consider consulting the Ministry of Manpower or legal professionals for specific advice.

What does an itemized payslip in Singapore require?

In Singapore, an itemised payslip should typically include essential details such as employee and employer information, basic salary, allowances, deductions, and net pay. It should also specify items like CPF (Central Provident Fund) contributions, tax information, and any other relevant employee benefits or reimbursements. The payslip also has to be compliant with local labour laws and regulations.

An itemised payslip in Singapore should include:

-

Employee Information

- Name

- Employee ID

- NRIC/FIN (National Registration Identity Card/Foreign Identification Number)

-

Employer Information

- Company name

- UEN (Unique Entity Number)

-

Salary Details

- Basic salary

- Allowances (housing, transport, etc.)

- Overtime pay (if applicable)

-

Deductions

- CPF contributions (employee and employer)

- Income tax deductions

- Other deductions (e.g., voluntary contributions, loans)

-

Benefits and Reimbursements

- Bonus

- Medical benefits

- Other benefits or allowances

-

Net Pay

- Total payable to the employee after deductions

-

Pay Period

- Start and end dates of the pay period

-

Leave Balances

- Accumulated leave balances (if applicable)

-

CPF Contributions Breakdown:

- Employee and employer CPF contributions, broken down into Ordinary, Special, and Medisave accounts.

-

Additional Information

- Any other relevant information required by labor laws or company policies.

Ensure that your itemised payslip complies with the Employment Act and other relevant regulations in Singapore. Keep in mind that this list may not be exhaustive, and it’s advisable to consult with a local HR professional or the Ministry of Manpower for the most up-to-date and accurate information.

Request For A Demo

Reach out to us for a free demo to find out more about OpensoftHR Payroll and HRMS Modules and also how the OpensoftHR Employee Self Service System allows your employee to download their own itemised payslip anytime.

Home

Home