In Singapore, navigating the complexities of overtime pay regulations while ensuring accuracy and compliance can be a daunting task for many businesses. From calculating overtime hours to staying updated with evolving labor laws, the process demands precision and efficiency.

Understanding Overtime Pay in Singapore

In Singapore, overtime pay constitutes a critical component of labor regulations, ensuring fair compensation for employees who work beyond regular hours.

Who is eligible for overtime pay in Singapore?

According to MOM (as of February 2024), the following working overtime employees are entitled to mandatory overtime pay:

- A non-workman earning a monthly basic salary of $2,600 or less.

- A workman (e.g. persons engaged in manual labour or persons in jobs stated in the First Schedule of the Employment Act, such as cleaners, bus/train drivers, or construction workers) earning a monthly basic salary of $4,500 or less.

How do you calculate overtime hours in Singapore?

Overtime pay is calculated as follows: Hourly basic rate of pay × 1.5 × number of hours worked overtime.

Please note that according to MOM, an employee can only work up to 72 overtime hours in a month. If an employer requires employees to work more than 12 hours a day (up to a maximum of 14 hours), they must apply for an overtime exemption.

You can find out more about how to calculate overtime hours in Singapore on the MOM website.

When can an employee claim for overtime?

An employee can claim for overtime if he or she works in excess of the contractual working hours.

Challenges of Manual Overtime Pay Calculations

In the digital age where technology streamlines even the most complex tasks, manually calculating overtime pay is not only outdated but also prone to errors and inefficiencies.

Here are some potential issues that you may face if you calculate overtime pay manually.

Human Error

Manual calculations are susceptible to errors, leading to inaccurate payments and potential legal disputes. Even the most meticulous individuals can make mistakes when performing repetitive calculations, especially when fatigued or under pressure to complete tasks quickly.

A single miscalculation can result in inaccurate payments, leading to dissatisfaction among employees and potential legal disputes.

Time-Consuming

Manually calculating overtime pay is time-consuming and labor-intensive. HR personnel must meticulously review timesheets, verify hours worked, and apply the appropriate overtime rates according to labor laws and company policies. This process can be particularly cumbersome for organizations with a large workforce or employees working irregular hours across different shifts or locations.

Compliance Risks

Labor laws governing overtime pay can vary by jurisdiction and are subject to change. Staying compliant with evolving regulations requires a deep understanding of labor laws and diligent monitoring of updates. Manual calculations increase the likelihood of overlooking regulatory changes or misinterpreting complex provisions, exposing organizations to compliance risks and potential legal consequences.

Lack of Scalability

As businesses expand and employee headcounts grow, manual processes become increasingly unsustainable. Managing overtime pay for a handful of employees may be manageable using manual methods, but it quickly becomes impractical as the organization scales. Manual calculations limit scalability and hinder the HR department’s ability to efficiently manage workforce time and attendance.

Audit Trail and Reporting

Manual calculations lack transparency and audit trails, making it difficult to provide accurate records during audits or disputes.

In this digital era, manual calculations are not only outdated but also prone to errors and inefficiencies, underscoring the need for automated solutions. Enter OpensoftHR’s Time Attendance Software, designed to streamline overtime pay management and empower businesses to navigate Singapore’s regulatory landscape with ease.

Leveraging OpensoftHR’s Time Attendance Software

OpensoftHR’s Time Attendance Software offers a comprehensive solution to streamline overtime pay management. At OpensoftHR, we have plenty of customers in the Construction, Engineering, Cleaning industries where employees are eligible for Mandatory Overtime Pay if they are working overtime.

Here is what we have in the OpensoftHR Time Attendance Software to help companies have a full overview and keep track of their employees’ overtime hours and overtime pay.

Customizable Overtime Rules

Administrators can configure the software to accommodate various overtime rules and regulations, including different pay rates for weekdays, weekends, and holidays.

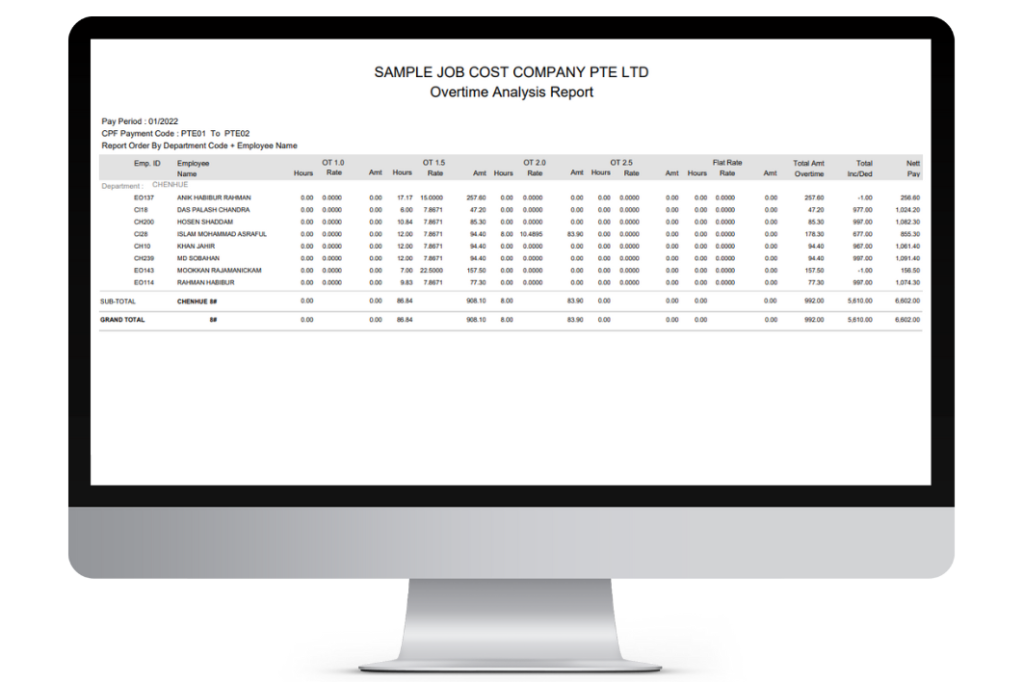

For example with OpensoftHR Time Attendance Software, you can set different OT rates for different employees. We have a very useful report called ‘Overtime Analysis Report’ where you can see the OT rates to be paid to each employee, the amount of overtime hours your employees have clocked each month, and the tabulated amount to pay each employee based on both their OT rates and overtime hours.

Integration with Payroll Systems

The OpensoftHR Time Attendance software seamlessly integrates with OpensoftHR Payroll or any Payroll of your choice, facilitating the transfer of accurate overtime data and eliminating manual data entry errors. This helps to facilitate the transfer of accurate overtime data for payroll processing, which helps to eliminate manual data entry and reduces the likelihood of payroll errors, saving time and costs in the long run.

Comprehensive Automated Reporting

Manually compiling time attendance reports from punch cards or written employee clock-ins and outs can be a laborious and error-prone task. The process not only consumes valuable time but also carries a high risk of inaccuracies.

Fortunately, with OpensoftHR Time Attendance Software, you can streamline your entire time attendance reporting process including overtime hours. By syncing seamlessly with your payroll system, OpensoftHR offers a cohesive HR operations experience, saving significant time and effort in the long run.

OpensoftHR empowers you to generate detailed overtime hours reports with just a few clicks. Some of the invaluable time attendance reports include:

- Overtime Analysis Report

- Monthly Lateness Report

- Absentees Listing Report

- Time Attendance Register Listing Report

These reports provide administrators with actionable insights into employee behavior and attendance patterns. They are instrumental for budgeting, forecasting, and ensuring compliance with regulatory requirements.

For instance, the Overtime Analysis Report allows you to discern the total number of overtime hours logged by employees within a specific timeframe. Moreover, it tabulates the corresponding amount owed to each employee based on their overtime hours and rates.

By leveraging these comprehensive reports, organizations can make informed decisions to enhance workforce productivity and optimize financial performance.

Conclusion

In conclusion, the limitations of manual overtime pay calculations underscore the importance of embracing technology-driven solutions. OpensoftHR’s Time Attendance Software offers a robust platform to automate overtime pay management, ensuring accuracy, compliance, and efficiency. By leveraging customizable rules, seamless integration with payroll systems, and comprehensive reporting capabilities, businesses in Singapore can streamline their overtime pay processes and focus on strategic initiatives.

Embrace automation with OpensoftHR Time Attendance and transform your overtime pay management experience today. Reach out to us for a free demo to find out more about OpensoftHR Time Attendance.

Home

Home